Small Business Development/RLF

Revolving Loan Fund Program Provides Faire Opportunities in DelawareRob Snowberger is a U.S. Navy Veteran and local entrepreneur in Wilmington, Delaware. In July 2019, he opened the Faire Market and Café, a grocery store and coffee service. In addition to offering the community more food choices, this unique endeavor also served as an economic revitalization project, bringing new customers to the downtown area. December 6, 2022 |

|

EDA-Capitalized Revolving Loan Fund Helps a Small Business Ascend to SuccessWhen psychologist Haleigh Scott completed her postdoctoral clinical training at the University of California, Davis she knew she could best continue her commitment to individuals with neurodevelopmental disabilities in a small setting that would allow personalized patient treatment and case management. However, the start-up costs needed to establish a private practice were prohibitive and, like many new entrepreneurs, Dr. Scott found it difficult to obtain traditional bank financing. That’s when she contacted Judy Fletcher, Chief Lending Officer at California Capital Financial Development Corporation (“California Capital”). November 29, 2022 |

|

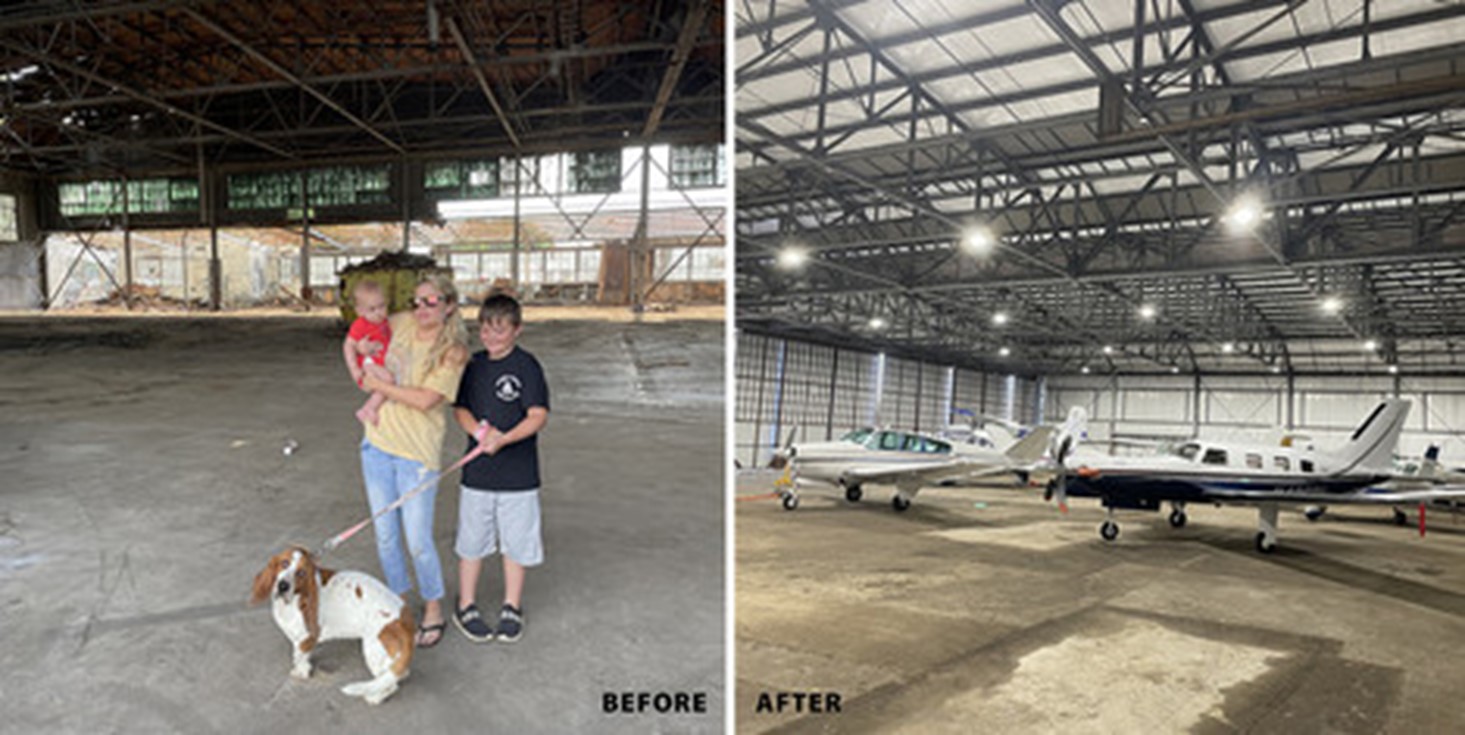

Revolving Loan Fund Program Gives Businesses a Flying Start in TennesseeMike Williamson is a former Air Force mechanic from Lynchburg, Tennessee. After serving his country, he returned to his hometown and opened Lynchburg Machine Tool, which provides tools and dies for the local automotive manufacturing industry. As his business took off, Mike was often traveling to meet with new customers. October 31, 2022 |

|

EDA Supports Equitable Lending LeadersWhile the accessibility of credit is vital to the success and growth of small business, research shows that lending to borrowers from marginalized communities continues to lag.1 In 2020, the CARES Act catalyzed a major expansion of the Economic Development Administration’s (EDA) successful Revolving Loan Fund (RLF) program. RLFs provide small businesses access to capital in the form of gap financing to grow and generate new employment opportunities with competitive wages and benefits. Prior to the onset of the pandemic, EDA’s RLF portfolio boasted a combined capital base of nearly $900 million; CARES Act recovery assistance helped grow the portfolio to more than $1.5 billion. October 6, 2022 |

|

Regional Planning Council Helps Small Businesses Stay Afloat in South FloridaOver the last few years, many Americans have moved to Florida, making it one of the top destinations for domestic migration. In 2021 alone, more than 220,000 people moved to the Sunshine State. Coupled with the onset of the coronavirus pandemic, this mass migration put a serious strain on the state’s resources, minimizing its lending power to small, minority-owned businesses and other entrepreneurs. September 1, 2022 |

|

EDA-Funded RLF Program Helps Keep Pharmacy Open in Small Town in LouisianaTewelde’s Lafitte Drugs has operated inside a grocery store in Lafitte, Louisiana, for more than 40 years. It has long served an important role in the rural community of 2,500 people. May 24, 2022 |

|

Pumps and Ladders: Francis Enos is Protecting the Protectors of California’s North CoastFire protection in California’s rural and heavily forested Humboldt County is provided by a patchwork of more than three dozen different agencies, many of whom rely entirely on volunteer firefighters. Maintaining the pumps and ladders on hundreds of pieces of firefighting apparatus along California’s North Coast is a job that’s almost as big as the giant Redwoods for which Humboldt County is known. It’s a job that falls, in part, to Ferndale, California’s Francis Enos Fire Pump Repair. April 12, 2022 |

|

Colorado Business on the Brink of Exponential GrowthBAR U EAT started, quite literally, in a home kitchen. Unsatisfied with the granola and protein bar options in local stores in Steamboat Springs, Colorado, Sam Nelson decided to make his own. He began making snack bars for family and friends and eventually they convinced him to sell the products. He teamed up with his life-long friend, Jason Friday, and BAR U EAT was created. March 29, 2022 |

|

EDA Support Helps Florida Relocation Company Move in a New DirectionAccording to the U.S. Census Bureau, more than 220,000 Americans moved to Florida in 2021, making it the nation’s top destination for domestic migration. March 15, 2022 |

|

Wisconsin Flower Shop Blooms Thanks to EDA-Funded Revolving Loan FundAs the coronavirus pandemic kept families and friends apart, sending flowers became an appealing option to show loved ones that they were missed. May 7, 2021 |

|

EDA and Feed the Hunger Help Stabilize Market Access for Hawaii’s Small FarmersThe coronavirus pandemic hit Hawaii’s tourist economy like the surf at Pe’ahi; almost overnight, visitor arrivals plummeted more than 99 percent.1 But the impact of the disaster was felt far beyond the normally crowded beaches and mega-resorts of Waikiki and Wailea. May 5, 2021 |

|

|

Economic Development Districts, Small Business/RLF In the Oregon Outback, an Iconic General Store Powers through the Pandemic with EDA SupportIn some rural parts of Eastern Oregon, the 1979 oil crisis wasn’t felt the same way it was in Seattle, Portland, or Boise. “We’ve never run out of gasoline to sell, but then we don’t sell a helluva lot,” Lloyd Grisel, then the owner of Hart Mountain Store in Oregon’s sparsely populated Lake County, was quoted in a July 1979 UPI article. April 14, 2021 |

|

Grocery Store Owners Improve Access to Local and Healthy Foods Thanks to RLF ProgramAccessing healthy and affordable foods is an increasing challenge to many North Dakota residents. Much of the state is rural and, according to the U.S. Department of Agriculture (USDA), a third of all counties have communities that are considered food deserts. The town of Velva relies on its local grocer, Velva Fresh Foods, which has become a key fixture within the community. Recently, the former owner decided to sell the store, and residents became concerned that it would no longer be a locally run business. They also feared that it might close permanently, as the next closest grocery store is more than 25 miles away. April 7, 2021 |

|

EDA-funded Revolving Loan Fund Helps Keep Business Manufacturing through pandemicSince 1991, The Flag Loft in St. Louis, Missouri, has been steadily manufacturing flags, banners, and fabric products for customers across the country. Customers include corporations, municipalities, colleges, high schools, professional sports teams, and the hotel industry. February 2021 |

|

EDA CARES Act Funding to Detroit Revolving Loan Fund Supports School for Aspiring BeauticiansBefore the coronavirus pandemic, about 80 aspiring beauticians attended classes at Dymond Designs Beauty School in downtown Detroit to learn about cosmetology, esthetics, manicuring, and natural hair cultivation. Now the school’s enrollment is about half, and most of the students are learning remotely. “The pandemic hit us hard. When we couldn’t train, everything stopped,” said school owner Marlene Brooks, whose students are mostly women of color living in the Detroit area. February 2021 |

|